# Time and Materials Billing

The BlueCollar T&M (Time & Materials) billing function supports billing customers for actual hours worked (labor), defined daily per diem add-on rates (per diem), the cost of materials used (inventory), as well as any other transaction type defined (transactions).

## Set-up and Dependencies for T&M Billing

The BlueCollar T&M Billing Template stores the pricing rules for Labor, Per Diem, Transactions, and Inventory items. These rules tell NetSuite how to calculate the billing rate or markup for your project costs. This rule-based approach provides:

- **Flexibility:** You can create multiple T&M Billing Templates to handle different projects, customers, or contract types.

- **Rule Stacking:** Each template can include many rules—each with its own criteria—so you can handle anything from simple hourly rates to complex vendor- or cost-code-based markups.

### Defining Labor Rules

Navigate to **BlueCollar > Time & Materials Billing > BlueCollar T&M Billing Template**

**Note:** Billing Classes should be defined prior to creating T&M Billing Templates (**BlueCollar > Time & Materials Billing > BlueCollar T&M Billing Class**). These are simply logical groups of billing classes.

**Tip:** Standardization of billing classes and templates will minimize system maintenance and reduce support. However, you may have as many Billing Templates as desired with as many row details as needed to support your business.

#### Creating a T&M Billing Template

1. Click **New** to create a new T&M Billing Template

2. Enter a clear, descriptive **Name** (e.g., "T&M Default Rules," "Acme T&M Rates")

3. Click **Save**

#### Adding Labor Details

1. Click the **Labor** sub-tab

2. Click **New BlueCollar T&M Billing Labor Detail**

3. Populate the following fields to support your business:

- **Name:** A clear label (e.g., "Pipe Welder - OT - Shift 2")

- **Employee:** Select a specific individual or leave blank for "All Employees"

- **T&M Billing Class:** Choose the role (e.g., "Laborer," "Dozer," "Head of Engineering," "Welding Specialist")

- **Earn Code:** ST, OT, DT, etc.

- **T&M Billing Cost Code (Optional):** If hours for certain tasks (e.g., "04500 - Equipment Operation") need unique rates

- **Shift:** If the rate varies by shift worked

- **Billing Rate:** The per-hour amount to charge customers

- **Related Service Item:** The NetSuite item used on your invoice

- **Rule Order:** The sequence in which the billing engine applies the rules

#### Real-World Examples for Labor Rules

**Straight Time vs. Overtime for a Single Billing Class**

- Example: "Laborer - ST - Shift 1" at $50/hr (Rule Order 1), and "Laborer - OT - Shift 1" at $75/hr (Rule Order 2)

- NetSuite applies the OT rate whenever the Earn Code is OT

**Differentiating Double-Time (DT)**

- Example: "Laborer - DT - Shift 1" with a higher rate (e.g., $100/hr)

- This ensures double-time is distinctly billed if hours exceed a threshold or local labor rules require DT

**Shift-Based Variation**

- Example: "Laborer - ST - Shift 2" at $100/hr, "Laborer - OT - Shift 2" at $150/hr

- This accounts for a second-shift premium on both straight time and overtime

**Skilled Roles**

- Example: "Head of Engineering - ST" at $500/hr (Rule Order 6)

- This covers specialized labor at a premium rate

**Named Employee or Equipment Operators**

- Example: "T&M Dozer" at $215/hr for all dozer operations, or a line specifically for "John Smith," if his rate differs from other employees in the same class

**Catch-All Rule**

- If you need a fallback rate (e.g., "All Employees - ST - Any Shift") to handle hours that don't fit into specialized lines, give it a higher Rule Order number (like 99) so it only applies if no other rule matches

#### Tips & Best Practices for Labor Rules

- **Clear Naming:** Label each rule so users immediately know the earn code, shift, and billing class

- **Prioritize with Rule Order:** The billing engine evaluates rules in sequence, so place the most specific rules first. For example, if Luke has a billing class of "Welder" and there is a rule for "Welder" and another rule for "Welder AND Luke," the second rule should be given a rule order before the first rule. If the first rule of just "Welder" were evaluated first, the second rule would never be triggered since Luke is a Welder and would meet the criteria of the first rule

- **Periodic Audits:** As pay scales or customer agreements change, revisit these lines to keep them current

- **Testing:** After adding or editing a rule, enter time for a scenario that should match your new rule, then confirm in the T&M Billing Tool that the correct rate applies

### Defining Transaction Rules

Transaction rules control how non-labor costs (bills, journal entries, expense reports, etc.) are marked up for billing to customers.

#### Adding Transaction Details

1. Click the **Transactions** sub-tab on your T&M Billing Template

2. Click **New BlueCollar T&M Transaction Detail**

3. Complete the following rule details:

- **Name:** Give the rule a descriptive name (e.g., "Journal Entries - 0% Markup")

- **Transaction Type:** Pick from Bill, Journal, Expense Report, Bill Credit, etc.

- **Entity (Optional):** If you want the rule to apply only to a specific vendor or entity, select that here

- **Related Cost Code / GL Account (Optional):** Narrow the rule to a certain cost code or account

- **Cost Item / Billing Item:** Indicate the default billing item to show on invoices

- **Cost Markup %:** Enter the markup (e.g., 0%, 10%). If no markup is desired, enter "0." The Gross Profit % will automatically adjust to show the Gross Profit % that will be earned by the markup defined with this rule

- **Gross Profit %:** This works hand in hand with Cost Markup % and updating one updates the other. This gives users two ways of describing markups—they can use Cost Markup % to define amounts they will markup costs by OR they can use Gross Profit % to define Gross Profit % that they want to make on this rule which will update the Cost Markup % to achieve this target

- **Rule Order:** Determine the sequence in which the billing engine applies the rules

4. Click **Save**

#### Real-World Examples for Transaction Rules

**Different Journal Entry Markups**

- **Example:** Journal entries that hit the "Payroll Taxes" GL Account get 0% markup, while journal entries against "Project Labor Overhead" get 10%

- **Setup Tips:**

- Create two separate detail lines, each with **Transaction Type = Journal**

- For line 1, set **GL Account** = "Payroll Taxes," **Cost Markup %** = 0%

- For line 2, set **GL Account** = "Project Labor Overhead," **Cost Markup %** = 10%

**Vendor-Specific Markups**

- **Example:** Vendor bills from "Acme Concrete" have a 15% markup, while standard vendors remain at 10%

- **Setup Tips:**

- Create a detail line named "Acme Concrete – 15%"

- **Transaction Type** = Bill; **Entity** = "Acme Concrete"

- **Cost Markup %** = 15%

- A second line ("Default Vendor Bill") can remain at 10%, applied to "Any Entity"

**Cost Code-Based Markups**

- **Example:** Site-Setup materials use cost code 01100 and carry a 10% markup, while Concrete (cost code 03300) has a 15% markup

- **Setup Tips:**

- Create one rule for "Site-Setup" with **Related Cost Code** = "01100," markup = 10%

- Another rule for "Concrete" with **Related Cost Code** = "03300," markup = 15%

**Combination: GL Account + Specific Cost Code**

- **Example:** Any journal entry posted to GL Account "Construction Materials" AND cost code "03300 – Concrete" gets a special 20% markup

- **Setup Tips:**

- Add one detail line with:

- **Transaction Type** = Journal

- **GL Account** = "Construction Materials"

- **Related Cost Code** = "03300 – Concrete"

- **Cost Markup %** = 20%

**Subcontractor Overhead Variation**

- **Example:** Subcontractor bills for HVAC might have 8% markup, while Electrical subcontractor bills are 5%

- **Setup Tips:**

- For HVAC:

- **Transaction Type** = Bill

- **Entity** = Your HVAC vendor's record

- **Markup %** = 8%

- For Electrical:

- **Transaction Type** = Bill

- **Entity** = Your electrical subcontractor's record

- **Markup %** = 5%

#### Tips & Best Practices for Transaction Rules

- **Rule Order Priority:** If there's any chance multiple rules could apply (e.g., same vendor, same cost code), set a Rule Order to ensure NetSuite picks the correct markup

- **Descriptive Naming:** Label each rule with a brief but clear description ("Vendor ABC – 15% Markup")

- **Regular Reviews:** Markups may change. Periodically revisit your T&M Transaction Detail lines to confirm they reflect current contract needs

- **Testing:** After creating or updating a rule, test a small transaction to verify the correct markup is applied

### Defining Per Diem Rules

Per Diem Rules allow users to define daily charges to be billed to customers per employee, per day. For example, employees may receive per diem of $100/day while working on a project. A typical use case is in the Oil and Gas industry where facilities are in remote locations and employees work during the week and are presumed to be away from home. For each day worked, users could define a rule which would bill $150/day to the customer.

#### Adding Per Diem Details

1. Navigate to the **Per Diem** subtab on your T&M Billing Template

2. Click **New BlueCollar T&M Per Diem Detail**

3. Complete the following fields:

- **Name:** Enter identification for this rule

- **Employee:** Specify employee this rule applies to (blank for all)

- **T&M Billing Class (Optional):** Specify the Billing Class this rule applies to

- **BlueCollar Cost Code (Optional):** Specify the Cost Code this rule applies to

- **Include Non-Working Days:**

- If you need to pay a per diem for non-working days, select this option

- **Note:** The project must have a BlueCollar Work Calendar specified in the project's advanced preferences. If this preference is selected and an employee works the day prior to a non-working day, a T&M Billing line will be generated for the next sequential non-working days from the associated calendar

- **Include Holidays:**

- If you need to pay a per diem for holidays, select this option

- **Note:** The project must have a BlueCollar Work Calendar specified in the project's advanced preferences. If this preference is selected and an employee works the day prior to a holiday, a T&M Billing line will be generated for the next sequential holidays from the associated calendar

- **Billing Rate:** Per diem rate to charge

- **Related Service Item:** The item that will show on the invoice

- **Rule Order:** Priority of this per diem rule

Each day an employee works on a project and meets the criteria specified for the rule, a T&M billing line will be created for the highest priority per diem rule with a quantity of 1.

### Defining Inventory Rules

Material T&M rules are triggered when inventory is received from a Transfer Order into a location defined as a project location in the BlueCollar Global Preferences. This will add markup or margin % to the transferred inventory and invoice the customer.

#### Adding Material Details

1. Navigate to the **Materials** subtab on your T&M Billing Template

2. Click **New BlueCollar T&M Material Detail**

3. Complete the following fields:

- **Name:** Enter identification for this rule

- **Pricing Method:** Select what field you'd like the change based on

- **Customer Price** will use native NetSuite pricing in sequence (Item Specific Pricing > Item Group Pricing > Price Level). If any of this is defined, it would use the customer price vs. a markup

- **Cost Markup %:** % of markup on item (will be disabled if customer price is selected)

- **Gross Profit %:** % of gross profit to achieve on the item (will be disabled if customer price is selected)

### Updating the Employee Record

The following fields should be populated on the Employee Record for any resources logging time:

- **BlueCollar Resource Rate Template:** To capture estimated labor costs

- **BlueCollar T&M Labor Billing Class:** Each employee who will enter time needs to have this field populated in order for the system to default their time under that class (to determine bill rate to the customer)

**Note:** On the time entry screen, there is a Labor Billing Class field; however, it can be left blank as it will default to the employee's Labor Billing Class when the field is left empty. The employee can set the Labor Billing Class if they don't have a default one or if their default one needs to change for the specific time entry they are working on.

## Processing T&M Billing

Once set-up is complete, time should be recorded using standard NetSuite timecard functionality (or loaded into NetSuite timecards if using an external time capture system).

### Fields That Impact T&M Rate Calculation

On the timecard, the following fields impact how the T&M rate is calculated:

- BlueCollar Project

- Class

- Cost Code

- Shift

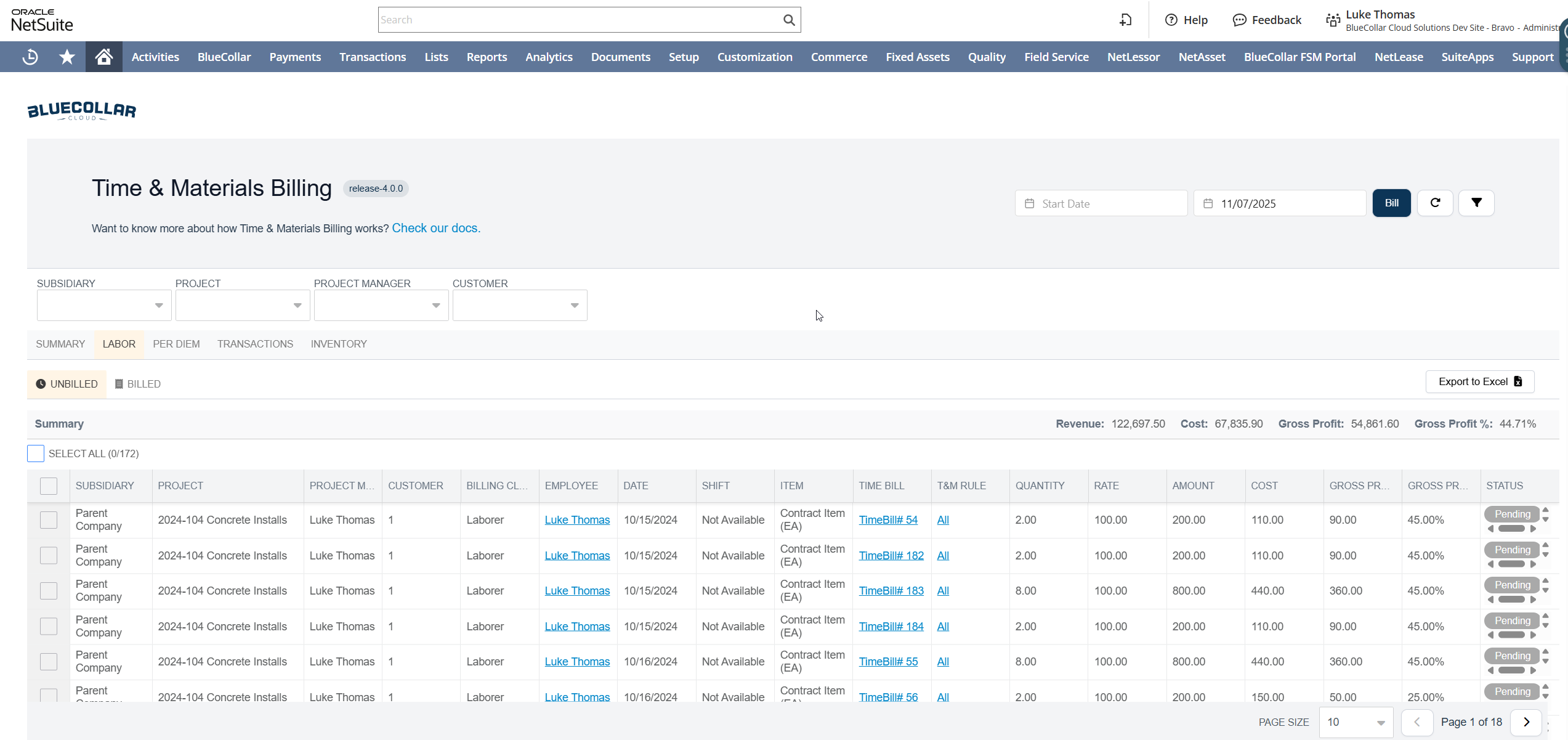

### Using the Time & Materials Billing Tool

The Billing Tool will review the time entered against the defined rules and auto-generate your invoices for T&M billing.

1. Navigate to **BlueCollar > Time & Materials Billing > Time & Materials Billing Tool**

2. Use filters at the top to narrow the list of time entries to review and process

3. Review entries

4. Make adjustments/overrides to the rate or quantity if needed

5. Select all or individual records to process

6. Click **Bill**

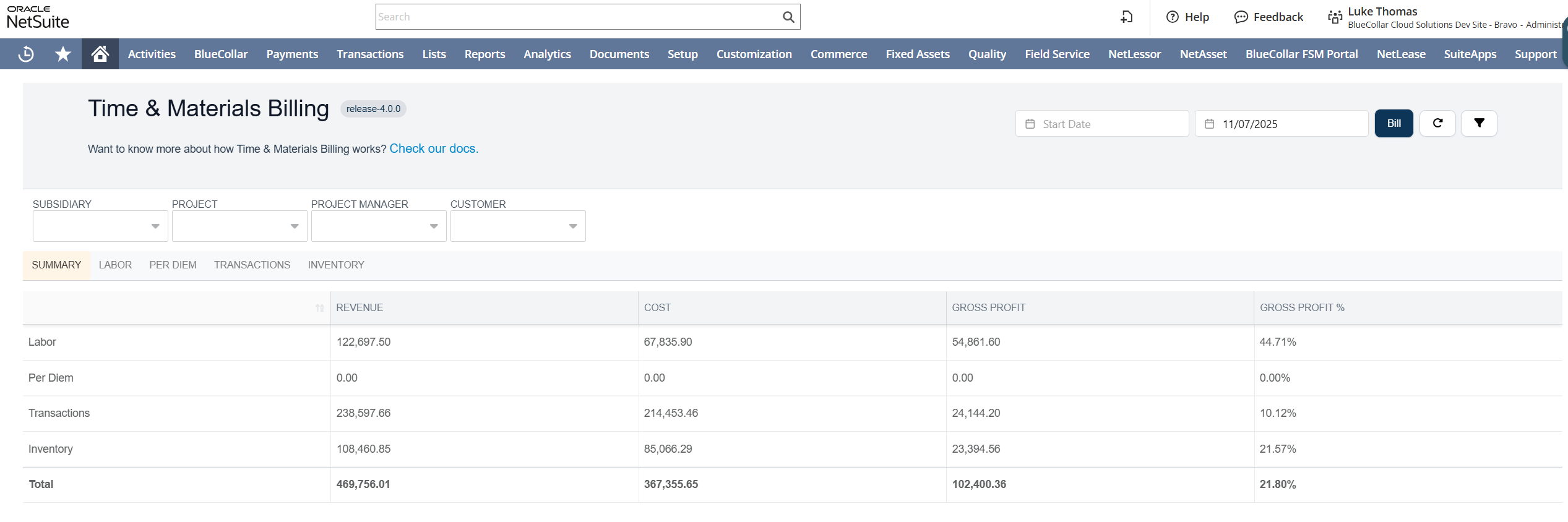

The amounts on the Summary page are totals for everything checked off on all the other tabs.